Women Give

Women Philanthropy Overview

The 2023 Bank of America Study of Philanthropy found that affluent women are driving positive change through their economic influence and strategic philanthropy. Eightly-five percent of affluent household charitable giving decisions were made or influenced by a woman, and significantly more women (42%) than men (33%) spent time volunteering in 2022 (Source: 2023 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households).

In 2025, total estimated charitable giving reached a new current-dollar high of $592.50 billion in 2024, up from $557.16 billion in 2023.

Four subsectors reached all-time highs even after adjusting for inflation:

Education: $88.32 billion (+13.2% current, +9.9% real)

Health: $60.51 billion (+5.0% current, +2.0% real)

Arts, Culture, and Humanities: $25.13 billion (+9.5% current, +6.4% real)

Environment/Animals: $21.57 billion (+7.7% current, +4.6% real)

EITC Giving & Opportunity

As charitable giving continues to grow in the education subsector, it is more important than ever to educate on how the EITC program works and the incredible impact it has on our kids and the community at large.

What is EITC?

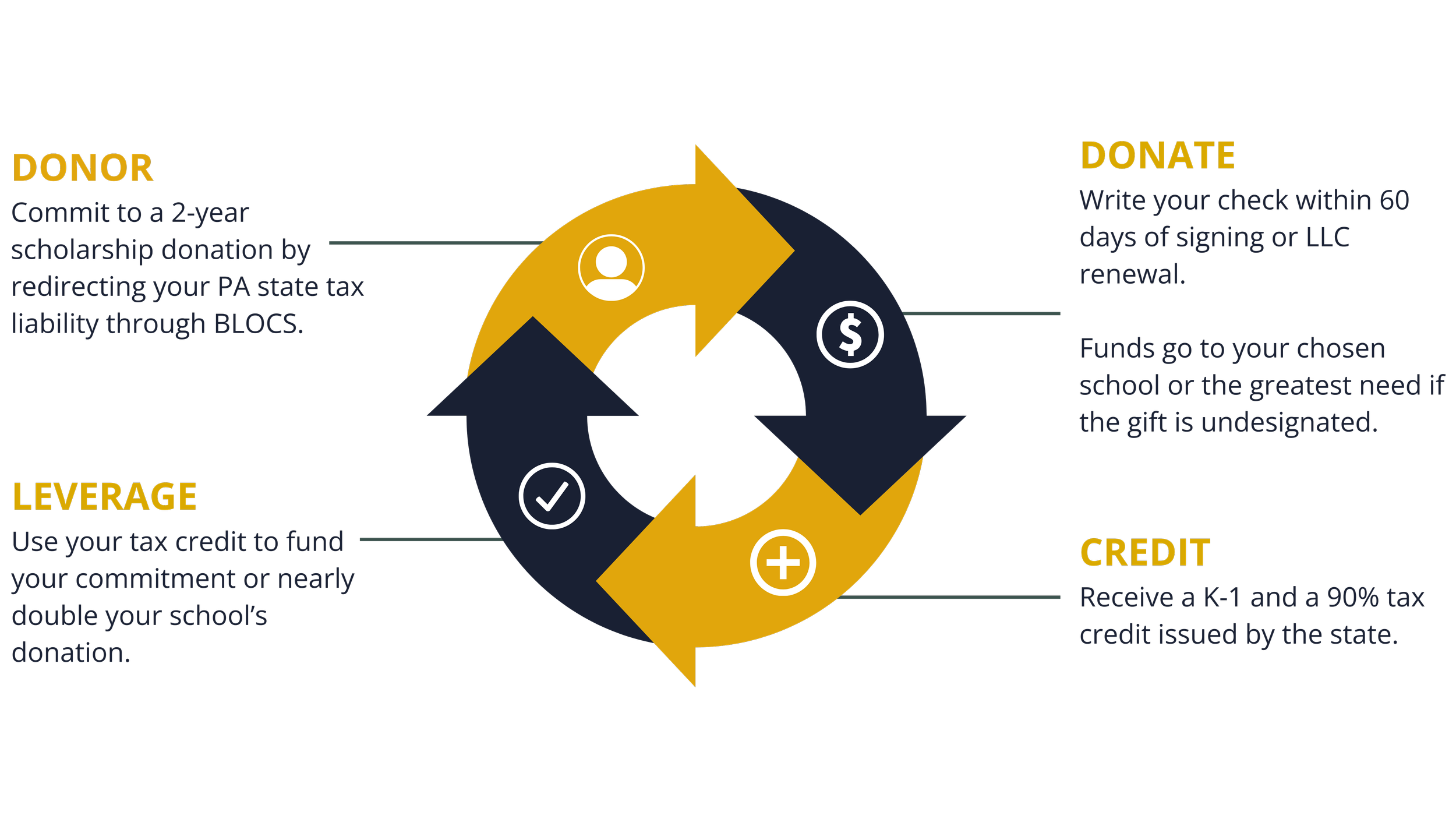

The Pennsylvania Educational Improvement Tax Credit (EITC) program is a state program that allows individuals and companies to make contributions to schools and receive up to a 90% tax credit.

An individual or company who wishes to take advantage of this tax-credit program may become a member of a BLOCS Scholarship LLC (“LLC”) with a 2-year commitment to fund the LLC. These credits will be distributed to each member via K-1 and are then applied to your PA tax liability for the tax year in which the donation is made.

BLOCS 123

BLOCS makes doing EITC as easy as 123

12 – Line 12 of your PA tax return (PA40)

3 – More than $3,000

Who pays more than $3,000 in PA taxes?

Families or individuals who make more than $100,000/ year

Businesses with more than $35,500 in net income

If you or your business owes more than $3,000 to Pennsylvania, you should be doing EITC.